“CreditVana Review: A Detailed Look at Its Free Credit Monitoring Claims”

Here’s a review of the website for CreditVana (via the link you provided). My goal is to present the positive aspects, the concerns, and some questions to ask before using the service.

✅ What looks good

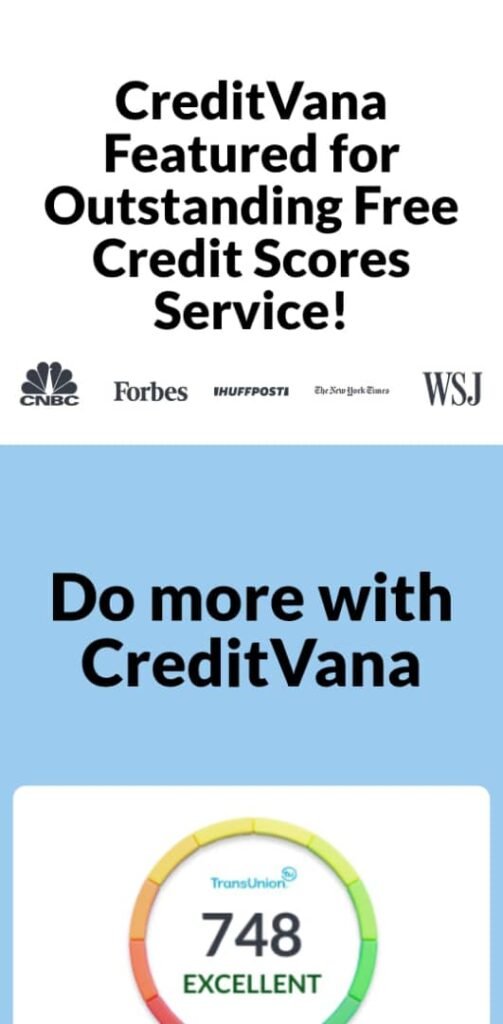

- Clear value-proposition: The homepage immediately states “Quickly check your credit scores 100% free of charge.” (Creditvana) This direct statement signals the core benefit.

- Free monitoring + score alerts: CreditVana advertises that users can get daily updates, free credit score monitoring and alerts for changes/suspicious activity. (Creditvana) This is a strong offer for someone wanting to stay on top of their credit profile.

- Usable statistics to demonstrate value: They show comparative examples (e.g., what a higher credit score could save you on a car, home, personal loan). (Creditvana) These illustrate the practical benefit of monitoring your credit.

- Mobile app available: They reference apps on Apple / Google stores. (Creditvana) If you prefer mobile access, that’s a plus.

- Transparency about the service provider / data source: It notes “Credit data provided by Experian ®”. (Creditvana) Having a known credit bureau as data provider is a positive sign.

⚠️ Areas of caution / things to check

- “Free” but possibly conditional: While the headline says “100% free,” many services of this kind convert to paid or have upsells (e.g., premium features). It’s important to check:

- What exactly is free (just viewing a score? updates? full report?).

- What features are locked unless you pay.

- Whether you must enter payment info to access the “free” tier.

- Privacy & data security: Anytime you’re giving access to your credit data (or personal identifying information) you want assurances:

- How is your data stored and protected?

- What happens if there’s a breach?

- Are there third-party partnerships/sellings of your data?

The site provides a “Privacy Policy” and “Terms of Use” link. (Creditvana) But you should read them thoroughly.

- Marketing language vs guarantee: For example, they show savings like “A better score could help save you over $85,000 on your home!” (Creditvana) While possible, these are illustrative—not a guarantee. Indeed the fine print says “[Credit Vana] does not guarantee credit score improvement.” (Creditvana)

- Scope and region of service: Credit-score systems differ by country. If you’re in a country outside the U.S., you’ll need to check whether the service applies:

- Does it use U.S. credit bureaus only (Experian U.S., etc.)?

- Is the monitoring relevant to your locale?

If you’re in Mogadishu/Somalia (as your profile suggests), check whether the service is valid/applicable there.

- Affiliates / commercial ties: The site has an “Affiliate Disclosure”. (Creditvana) It may mean they earn commissions for sending users to certain financial products. That’s not inherently bad, but it means you should assess their product recommendations carefully.

- Ambiguous content or non-relevant items: I noted something odd: at the bottom of the page there’s a line referencing Indonesian language “Jelajahi koleksi slot gacor di …” (gambling-style content). (Creditvana) That is concerning because it may indicate the site has been repurposed, or contains linkouts to less-relevant or potentially risky content. It raises questions about site governance/quality control.

- How deep the “free” credit report is: It says “Free Credit Report Card”. (Creditvana) But many services give only a summary rather than full details of your credit file (all accounts, inquiries, etc.). You should check exactly what the “report” includes.

🔍 My general impression

Overall, CreditVana positions itself as a solid, user-friendly platform for monitoring your credit score and getting alerts. The fact that it uses a major bureau (Experian) adds credibility. If everything works as advertised, it could be very useful—especially if you are actively trying to improve or keep tabs on your credit.

However, as with any financial service, the devil is in the details. The “free” claim invites scrutiny: how long free, what features, and what upsells follow. Also, since you appear to be in Somalia (though I don’t know if you intend to use a U.S.-based credit service), you’ll want to verify whether the service works in your country/region or whether you’ll be tracking U.S. credit only.

The odd inclusion of gambling-style text in the footer (in a non-English language) gives me pause about the site’s overall stability and cleanliness. It may be benign (maybe an advertisement), but it’s still a flag.

📝 Recommendations if you consider using it

- Read the Terms of Use and Privacy Policy fully: check for data sharing, cost triggers, cancellation terms.

- Before entering sensitive personal information (SSN, etc.), verify how the login/enrollment works and what you’re consenting to.

- Check which credit bureau(s) are covered and whether your country/credit system is supported. If you only have a credit file in your home country (Somalia), a U.S. service might have little meaning.

- Test the “free” tier first: sign up with minimal info (if possible), see what you get, what you don’t, and how much they later try to upsell.

- If they offer alerts/monitoring, ensure the alerts are timely and meaningful (e.g., changes to your file, new inquiries, fraud).

- Use the service as part of a broader credit-health strategy: monitor, but also pay on time, keep balances low, avoid unnecessary credit inquiries, etc. The site mentions that score improvement depends on behavior. (Creditvana)

- If you find the service does not really reflect your locale, consider local credit monitoring options (if any) for your country.

- Keep aware of marketing: platforms that promise big savings or “instant improvement” tend to oversell. Take the claims as illustrative, not guaranteed.

📌 Summary

In summary: Yes — CreditVana looks like a legitimate and potentially useful tool for credit monitoring and score tracking, especially if you’re in a region supported by the service. It has many of the right features. But:

- Check that “free” really means free (and what exactly you get).

- Confirm coverage and relevance for your region.

- Read all the disclosures and policies.

- Be aware that merely signing up doesn’t guarantee credit improvement — your actions matter.

If you like, I can do a deeper dive on user reviews (what people say about CreditVana in practice), compare it to alternate services, and highlight any hidden fees or complaints. Would you like me to do that?

visit creditvanahttps://creditvana.pxf.io/2aZzkG